The decision to pursue higher education is one of the most significant choices many individuals make in their lives. However, attending college often comes with a hefty price tag that may leave students wondering how they can finance their education. One of the most common ways students fund their studies is by taking out student loans. While student loans can provide much-needed financial support, they also come with long-term consequences and obligations. Before deciding to take out a student loan for college, it’s crucial to consider various factors that will influence your decision.

This article will explore the pros and cons of taking out a student loan, the different types of student loans available, how to assess your financial situation, and alternative ways to fund your education. In the end, we’ll answer seven frequently asked questions (FAQs) related to student loans and provide key takeaways to help you make an informed decision.

Key Takeaways

- Student loans provide access to higher education but come with significant long-term financial obligations.

- Federal student loans typically offer lower interest rates and better repayment options than private loans.

- It’s essential to consider your future income potential and explore all financial aid options before taking out loans.

- Student loan debt can have long-lasting impacts on your financial future, so carefully assess your ability to manage payments after graduation.

The Pros of Taking Out a Student Loan for College

Access to Higher Education

The most apparent benefit of taking out a student loan is that it provides access to higher education. College tuition has been steadily increasing, and without loans, many students may not have the financial means to attend. By borrowing money to finance your education, you are able to pursue a degree that could lead to better career opportunities, higher earning potential, and greater personal growth.

Deferred Repayment

Student loans typically offer deferred repayment options, meaning you don’t have to start paying back the loan until after you graduate. This gives you time to focus on your studies without the added stress of worrying about how to make loan payments. For federal student loans, the interest might even be subsidized while you’re still in school (depending on the type of loan), which can make the loan more affordable in the long run.

Lower Interest Rates

Federal student loans, in particular, tend to offer lower interest rates than private loans or credit cards. These loans often come with fixed interest rates, which means you’ll know exactly how much you’ll pay over the life of the loan. This stability can help you plan and budget more effectively.

Flexible Repayment Plans

Federal student loans offer various repayment plans to suit different financial situations. Some plans include Income-Driven Repayment (IDR) options, where your monthly payments are based on your income and family size. This flexibility can make it easier to manage loan payments once you graduate, especially if you enter a field with lower-than-expected starting salaries.

Build Credit History

Taking out a student loan and responsibly managing it by making on-time payments can help you establish a positive credit history. A good credit score is crucial for many aspects of adult life, including renting an apartment, purchasing a car, or applying for a mortgage. Successfully paying off student loans can demonstrate to future lenders that you are a responsible borrower.

Tax Benefits

Certain student loans come with tax benefits. For instance, you may be able to deduct up to $2,500 in student loan interest from your taxable income each year. This can help reduce the total amount of taxes you owe, thus providing some financial relief as you pay down your loan.

Public Service Loan Forgiveness

For students pursuing careers in public service fields, there is the potential to have a portion of their loan forgiven through Public Service Loan Forgiveness (PSLF) programs. If you work for a qualified employer, such as a government agency or nonprofit organization, and make qualifying monthly payments for a set number of years, the remaining balance of your loan may be forgiven.

The Cons of Taking Out a Student Loan for College

While student loans come with several benefits, they also carry significant risks and drawbacks. Before committing to borrowing money for college, it’s essential to weigh these potential downsides.

Accruing Debt

The most obvious disadvantage of taking out a student loan is the accumulation of debt. Even with deferred repayment, interest continues to accrue while you’re in school, and when you graduate, you will be left with a significant amount of debt that must be repaid. This debt burden can last for many years, and for some, it may take decades to pay off.

Interest Costs

While federal student loans tend to have lower interest rates, they still come with significant costs. The interest you pay on your loans can add up over time, sometimes doubling or even tripling the amount you originally borrowed. This means that you could end up paying much more than the cost of your education, especially if you’re unable to make larger payments during your grace period or while still in school.

Limited Career Flexibility

Taking on a large amount of student loan debt may limit your career flexibility after graduation. If you have to make high monthly loan payments, you may find it challenging to take a job that doesn’t pay well or to switch careers if an opportunity arises. Many graduates feel pressure to accept jobs solely based on salary rather than personal passion or career growth.

Stress and Mental Health Concerns

The burden of student loan debt can lead to financial stress, anxiety, and mental health struggles. The constant worry about how you’ll pay off your loans can overshadow your post-graduation life. Moreover, if you are unable to make payments or miss a payment, it could negatively impact your credit score and increase your debt.

Loan Forgiveness Isn’t Guaranteed

While there are loan forgiveness programs available for certain public service jobs, these programs are highly competitive and require long-term commitment. Even if you qualify for PSLF or similar programs, there’s no guarantee that your loan will be forgiven, and you could end up having to pay back the full amount.

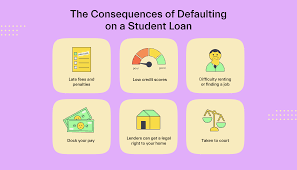

Potential for Default

If you fail to repay your student loan, it could result in default, which means you may lose access to important financial services, including your ability to borrow money in the future. Defaulting on your loan can also lead to wage garnishment and tax refund offsets, making it even more difficult to recover financially.

Impact on Your Financial Future

Student loans can affect your ability to save for important financial milestones, such as buying a house, getting married, or starting a family. The long repayment periods can delay these significant life events, and for some individuals, it might take years before they are financially stable enough to make these decisions.

Assessing Whether a Student Loan Is Right for You

Before deciding to take out a student loan, it’s essential to assess your financial situation carefully. Here are several factors to consider:

Expected Future Income

Do some research on the potential salaries in your field of study. If you plan to major in a subject with a high earning potential (such as engineering, computer science, or healthcare), taking on student debt may be more manageable because you’re likely to earn a good income after graduation. However, if you are pursuing a degree in a field with lower-paying job prospects (such as the arts or social work), you may struggle to make student loan payments on a modest salary.

Available Financial Aid

Explore all financial aid options before committing to student loans. Scholarships, grants, and work-study programs are valuable alternatives to loans that don’t need to be repaid. If you qualify for these, you may be able to reduce the amount of debt you need to incur.

Loan Type

As mentioned earlier, federal student loans often offer lower interest rates and more favorable repayment terms than private loans. If you must take out a loan, federal student loans should be your first choice. Only consider private loans if you have no other options, and be sure to compare interest rates, repayment plans, and fees.

Your Financial Responsibility

Taking out a loan is a significant financial commitment. Make sure you fully understand the terms and obligations of the loan, including the interest rates and repayment timeline. Create a budget and assess whether you will be able to manage loan payments after graduation. Be realistic about your future earnings and lifestyle.

Also Read: What Is a Student Loan and How Does It Work?

Conclusion

Taking out a student loan is a major financial decision that should not be taken lightly. While student loans provide an opportunity to pursue higher education, they also come with long-term debt obligations. Before borrowing, carefully consider your career goals, financial situation, and repayment options. Be sure to exhaust all other forms of financial aid, such as scholarships and grants, before relying on loans.

Ultimately, whether or not you should take out a student loan depends on your unique circumstances, including your chosen field of study, future earning potential, and ability to manage debt responsibly.

FAQs

1. What is the difference between federal and private student loans?

Federal student loans are offered by the government and typically have lower interest rates, more flexible repayment options, and additional borrower protections, such as income-driven repayment plans and potential loan forgiveness. Private loans are offered by banks or other financial institutions and often come with higher interest rates, less flexible repayment plans, and fewer protections.

2. How much student loan debt is considered too much?

The amount of student loan debt that’s considered “too much” depends on your future income potential and your ability to repay the loan. A good rule of thumb is that your total student loan debt should not exceed your anticipated annual salary after graduation. For example, if you expect to earn $50,000 a year, your total student loan debt should ideally be less than or equal to that amount.

3. Can I consolidate my student loans?

Yes, both federal and private student loans can be consolidated, although the process differs between the two. Federal loans can be consolidated into a Direct Consolidation Loan, while private loans can be consolidated through private lenders. Consolidation can simplify repayment but may affect your loan terms, including interest rates.

4. What happens if I can’t afford my student loan payments?

If you can’t afford your student loan payments, you have options. For federal loans, you can apply for deferment or forbearance, which temporarily postpones payments. Alternatively, you can enroll in an income-driven repayment plan. For private loans, contact your lender to discuss your options, as they may offer alternative repayment arrangements.

5. Can I pay off my student loan early?

Yes, you can pay off your student loan early without facing any penalties. Paying off your loan early will reduce the amount of interest you pay over time and help you become debt-free faster.

6. What is student loan forgiveness?

Student loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), allow borrowers who work in certain public service sectors to have their loans forgiven after a set number of qualifying payments. However, these programs have strict eligibility requirements and long waiting periods.

7. How do I apply for student loans?

To apply for federal student loans, fill out the Free Application for Federal Student Aid (FAFSA). For private loans, you’ll need to apply directly with lenders, providing information about your credit history and financial situation.