Student loans are one of the most significant financial burdens many people carry. For some, they serve as an investment in their education and future career, but the road to paying them off can be a long and challenging one. As of recent reports, student debt in the United States has topped $1.7 trillion, and the average graduate carries over $30,000 in loans. But there’s good news—there are several ways to pay off your student loans faster, saving you money on interest and allowing you to achieve financial freedom sooner.

This article will dive into actionable strategies you can use to pay off your student loans more quickly, as well as key considerations to help you make smarter financial decisions along the way.

Key Takeaway

- Refinancing can help lower interest rates and reduce the time it takes to pay off loans.

- Making extra payments, even small ones, will reduce principal and interest over time.

- Employer repayment assistance and windfalls (like tax refunds) can accelerate loan repayment.

- Explore income-driven repayment and loan forgiveness options if they align with your career and financial goals.

- Consistent, timely payments through automatic deductions can help you stay on track.

Refinance Your Student Loans

Refinancing is one of the most effective ways to reduce the cost of your student loan and shorten your repayment term. When you refinance, you essentially take out a new loan to pay off your old ones, ideally at a lower interest rate. If your credit score has improved since you first took out the loan, or if you’re now earning more money, refinancing can be a good option.

How Refinancing Helps:

- Lower Interest Rates: The main reason people refinance is to secure a lower interest rate, which reduces the amount of money you’ll pay over the life of the loan.

- Shorten the Loan Term: By refinancing to a shorter loan term, you can pay off your debt faster. This might come with higher monthly payments, but you’ll pay less in interest overall.

- Combine Loans: Refinancing can consolidate multiple loans into one, making it easier to manage your payments.

Key Considerations:

- Eligibility: To refinance, you’ll need a good credit score and a stable income. If you’re struggling with low credit or job instability, refinancing may not be a viable option.

- Federal Loan Benefits: Refinancing federal loans means you’ll lose access to federal protections, like income-driven repayment plans or loan forgiveness. Be sure to weigh the pros and cons carefully.

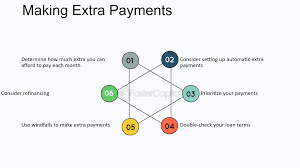

Make Extra Payments

The simplest and most straightforward way to pay off student loans faster is by making extra payments. Even small amounts can make a significant difference over time by reducing your principal balance and the interest that accrues.

How Extra Payments Help:

- Pay Down Principal Faster: Extra payments reduce the principal balance, which means less interest accrues over time.

- More Savings in Interest: Since interest is calculated on your outstanding balance, the smaller your balance, the less you’ll pay in interest over time.

Key Tips for Making Extra Payments:

- Pay More Than the Minimum: Whenever possible, try to pay more than the minimum required monthly payment. If you can make an additional payment every month or pay a little extra each time, you’ll chip away at the debt faster.

- Make Biweekly Payments: Rather than making one monthly payment, divide your monthly payment in half and pay that amount every two weeks. This way, you’ll make 26 payments over the course of the year, instead of just 12.

- Round Up Payments: Round your payments up to the nearest hundred or thousand to make a dent in the loan more quickly.

Utilize Income-Driven Repayment Plans

If you’re struggling with your current student loan payments, income-driven repayment (IDR) plans may be a helpful option. These plans adjust your monthly payments based on your income and family size, often lowering them significantly.

How IDR Plans Help:

- Lower Payments: With income-driven repayment, your monthly payments will be adjusted to fit your budget, often making them more affordable.

- Loan Forgiveness: After 20 or 25 years of qualifying payments under an IDR plan, your remaining loan balance could be forgiven. However, this is a longer-term solution and may not help you pay off the loan quickly.

Key Considerations:

- Interest Accumulation: While IDR plans offer lower payments, they also extend the repayment period, meaning you could end up paying more in interest in the long run.

- Eligibility: These plans are available for federal student loans but not for private loans.

Take Advantage of Employer Loan Repayment Assistance

Many employers are now offering student loan repayment assistance as a part of their benefits packages. In fact, according to recent surveys, more than 8% of employers in the U.S. provide some form of student loan assistance to their employees. If your employer offers this benefit, it can be an excellent way to accelerate your loan payoff.

How Employer Assistance Helps:

- Supplement Your Payments: Your employer may match a portion of your monthly payments or offer a lump-sum contribution toward your loan balance.

- Tax-Free Benefits: As of 2025, employers can contribute up to $5,250 annually toward student loans without the contributions being taxed as income, which can significantly reduce your loan balance.

Key Considerations:

- Eligibility: Not all employers offer this benefit, and there may be specific eligibility requirements (like a minimum amount of time worked at the company).

- Plan Structure: Understand how the program works—some employers may offer matching funds, while others may have a flat repayment amount.

Use Windfalls and Tax Refunds

Another effective strategy to pay off student loans faster is to apply windfalls or tax refunds directly toward your student loan balance. If you receive a bonus at work, a tax refund, or any other unexpected income, consider using these funds to make a lump-sum payment on your loans.

How Windfalls Help:

- Principal Reduction: Large, lump-sum payments can drastically reduce your principal balance, which in turn reduces the interest you’ll pay over time.

- Accelerated Payoff: By making a large one-time payment, you can shorten the term of your loan and free up money for other financial goals.

Key Considerations:

- Avoid Spending the Windfall: The temptation to use a bonus or tax refund for something fun or discretionary is high, but applying it to your student loan balance will help you achieve long-term financial freedom.

- Check Loan Terms: Before applying windfalls, check with your loan servicer to ensure there are no prepayment penalties.

Consider Loan Forgiveness Programs

For certain professions, there are student loan forgiveness programs that can help you eliminate part or all of your student debt. These programs are available for public service employees, teachers, healthcare workers, and others working in qualifying fields.

How Loan Forgiveness Helps:

- Public Service Loan Forgiveness (PSLF): If you work for a qualifying government or nonprofit organization, you could have your loans forgiven after 10 years of qualifying payments.

- Teacher Loan Forgiveness: Teachers working in low-income schools can have up to $17,500 of their loans forgiven after five years of service.

- Nursing and Healthcare Loan Forgiveness: Healthcare workers may qualify for loan repayment assistance or forgiveness programs.

Key Considerations:

- Qualifying Payments: Loan forgiveness typically requires consistent payments under an eligible repayment plan for a set number of years.

- Tax Implications: Some forgiveness programs may have tax implications, so it’s important to plan ahead.

Automate Your Payments

Setting up automatic payments not only ensures you never miss a payment, but it can also help you pay off your loan faster. Many loan servicers offer a small interest rate reduction for borrowers who set up autopay, typically around 0.25%.

How Automation Helps:

- On-Time Payments: Automation ensures that your payments are always made on time, avoiding late fees and potential credit damage.

- Consistency: By making consistent payments, you’ll reduce the balance over time, helping you stay on track to pay off your loan faster.

Key Considerations:

- Ensure Sufficient Funds: Make sure you always have enough money in your bank account to cover your loan payments, as failed payments could result in late fees or penalties.

Also Read: What Is a Student Loan and How Does It Work?

Conclusion

Paying off student loans faster requires discipline, strategy, and a clear plan. Whether you choose to refinance, make extra payments, or explore loan forgiveness options, there are multiple ways to reduce your loan balance quickly. While some options, such as refinancing, may offer immediate savings, others like loan forgiveness can be long-term solutions for those in qualifying professions. Regardless of the approach you choose, the key is to remain proactive and consistent in your efforts.

FAQs

1. Is refinancing a good idea if I have federal student loans?

Refinancing federal student loans to a private lender can offer a lower interest rate, but you’ll lose the benefits of federal protections, such as income-driven repayment plans and loan forgiveness. Weigh the pros and cons carefully.

2. Can I make extra payments without a penalty?

Most federal student loans allow you to make extra payments without penalty. However, you should confirm the terms with your loan servicer, especially for private loans, as some lenders may charge prepayment penalties.

3. How do income-driven repayment plans work?

Income-driven repayment plans adjust your monthly payment based on your income and family size, making them more affordable. After 20-25 years of qualifying payments, any remaining balance may be forgiven.

4. What if I can’t afford to pay extra on my loans?

If you can’t afford to make extra payments, consider switching to an income-driven repayment plan to reduce your monthly payments. You can also explore loan deferment or forbearance as temporary solutions.

5. Can loan forgiveness programs be used with private loans?

Most loan forgiveness programs are only available for federal loans. Private lenders do not typically offer forgiveness options.

6. Will I pay more in interest with a longer repayment plan?

Yes. Longer repayment plans generally come with lower monthly payments but result in more interest over time due to the extended loan term.

7. How can I check if my employer offers student loan repayment assistance?

Check your employer’s benefits portal or speak to your HR department to find out if student loan repayment assistance is available.